Multiple Choice

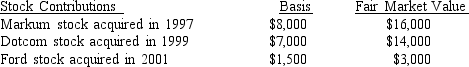

What is Beth's maximum allowable deduction for the following contributions to qualified public charities during the current year if her adjusted gross income is $90,000?

A) $45,000

B) $33,000

C) $27,000

D) $16,500

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q20: Justin, age 42 and divorced, is the

Q24: An abandoned spouse must only live apart

Q43: Jan and James's divorce is final on

Q49: In 2018, Amber earned a salary of

Q50: Surviving spouse status may be claimed for

Q50: Maurice and Judy (both age 32) have

Q51: For 2018-2025, the personal and dependency exemption

Q58: Torri is a sixth grade teacher. In

Q59: Cliff is married and files a joint

Q60: Taxpayers can apply any excess FICA tax