Multiple Choice

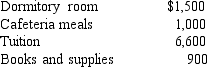

Natasha graduated at the top of her high school class and received a $10,000 scholarship to attend the college of her choice. Natasha decided to attend State University and spent her $10,000 as follows:  How much of the $10,000 should Natasha report as gross income?

How much of the $10,000 should Natasha report as gross income?

A) $10,000

B) $3,400

C) $2,500

D) $1,500

E) zero

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The recipient's basis in a gift always

Q53: Up to 85 percent of a person's

Q58: All of the following result in nontaxable

Q60: In January, Zelda borrows $7,000 from her

Q62: Under the source principle of international taxation,

Q73: Tighe won a new automobile from his

Q77: Constructive receipt requires an accrual basis taxpayer

Q119: When is money received in the form

Q121: Explain the normal tax treatment of life

Q129: Explain the tax treatment of a gift