Essay

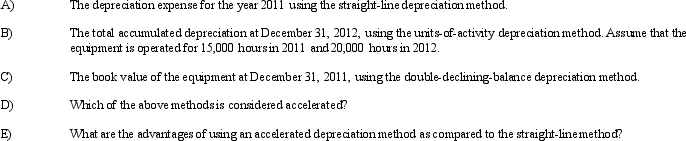

Apache, Inc. purchased equipment at the beginning of 2011 for $91,000. In addition, Apache paid $5,000 for delivery of the equipment to its plant and $5,000 for installation of the equipment. The equipment has an estimated salvage value of $9,000 and an estimated life of 8 years or 100,000 hours of operation. Apache is looking at alternative depreciation methods for the equipment. Determine the following:

Correct Answer:

Verified

Correct Answer:

Verified

Q77: Able Company purchased land and incurred

Q78: Butler Corporation uses plant assets that are

Q79: Aggie, Inc. <br>Aggie, Inc. purchased a truck

Q80: A machine with a cost of $80,000

Q81: The effect of recording depreciation for the

Q84: Aggie, Inc. <br>Aggie, Inc. purchased a truck

Q85: Fisher Apartments purchased an apartment building to

Q86: Cash paid to purchase significant amounts of

Q87: Assets classified as property, plant, and equipment

Q187: Cash flows from acquiring and disposing of