Essay

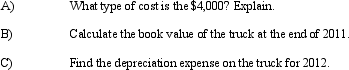

Marshall Company purchased a truck for deliveries for $25,000 at the beginning of 2011. The truck had an estimated life of 5 years, and an estimated salvage value of $5,000. Marshall used the straight-line depreciation method. At the beginning of 2012, Marshall incurred $4,000 to replace the truck's transmission. This resulted in a 2-year extension of the truck's useful life, but no change in the residual value.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Xtra Company purchased goodwill from Argus for

Q36: Which of the following is an intangible

Q37: Clear Window Cleaners <br>Clear Window Cleaners purchased

Q38: Arnold, Inc. purchased a truck on January

Q39: Clear Window Cleaners <br>Clear Window Cleaners purchased

Q42: Using the straight-line depreciation method will cause

Q43: A disposal of a used delivery truck

Q44: _ refers to the market value of

Q46: Gump Shrimp Company <br>On January 1, 2011,

Q184: Which of the following is not an