Essay

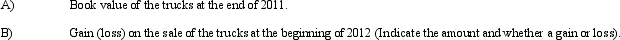

Baxter Tile, Inc. purchased new trucks at the beginning of 2011 for $400,000. The trucks had an estimated life of 5 years and an estimated salvage value of $50,000. Baxter Tile uses straight-line depreciation. At the beginning of 2012, Baxter sold the trucks for $350,000 and purchased new trucks for $500,000. Determine the following amounts:

Correct Answer:

Verified

Correct Answer:

Verified

Q54: Max's Tire Center Company <br>Selected data from

Q55: Everett, Inc. <br>Information for Everett, Inc. for

Q56: Which of the following is included in

Q57: Wilshire purchased equipment at the beginning of

Q58: Disc Company purchased equipment at the beginning

Q60: On December 31, Strike Company has decided

Q61: If technology changes rapidly, a firm should:<br>A)

Q62: Upon review of Bert's statement of cash

Q63: Peck Tech. purchased a patent at the

Q64: Gump Shrimp Company <br>On January 1, 2011,