Essay

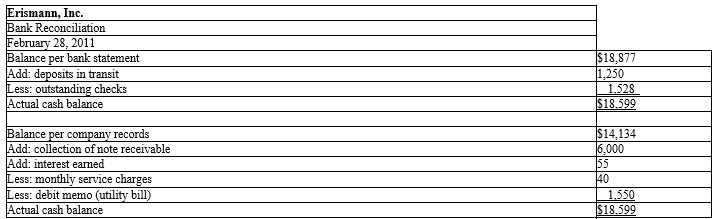

The accounting records for Erismann, Inc. shows a cash balance of $14,134 on February 28, 2011. On the evening of February 28, company receipts of $1,250 were placed in the bank's night deposit drop box; this deposit was processed by the bank on March 1. The February 28 bank statement shows balance of $18,877, including collection of a $6,000 note receivable plus $55 of interest earned, a service charge of $40, and a $1,550 debit memo for the payment of the company's utility bill. All of the checks that the company had written during January were listed on the bank statement except for check #1908 in the amount of $1,528.

Prepare a bank reconciliation to calculate the adjusted cash balance for Erismann's checking account at February 28, 2011. Prepare the journal entries that Erismann must record to adjust its cash records as a result of the bank reconciliation procedures.

Correct Answer:

Verified

Correct Answer:

Verified

Q57: Madrid Consulting, Inc. <br>Madrid Consulting, Inc. prepared

Q58: Jennitt Inc. established a petty cash fund

Q59: Bloom's Garden Center Company <br>Selected data from

Q63: During April, Stephen's Erectors engaged in the

Q64: Which of the following is not considered

Q71: A company's bank statement balance shows that

Q89: If a company erroneously records a $500

Q122: An amount recorded as an increase in

Q174: Under the _ Act, management of publicly-traded

Q180: Cash collected and recorded by a company