Multiple Choice

Suppose that a business sells 6-month subscriptions to its monthly magazine. On January 1, the company receives a total of $600 for 10 subscriptions. To record this transaction, the company debits "Cash" for $600 and credits "Unearned Subscription Revenue" for $600. As of January 31, the company has provided one month of magazines and has earned one month of revenue. What adjusting entry is necessary at January 31?

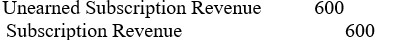

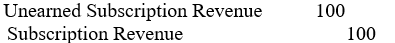

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q14: What are adjusting entries and what is

Q33: A company forgot to record four adjustments

Q34: FedZ is a local package delivery service.

Q37: Which of the following entries properly closes

Q39: Which one of the following adjustments will

Q40: Which of the following statements present financial

Q43: Suppose a company received a $2,500 utility

Q93: Failure to record dividends paid would result

Q102: The post-closing trial balance differs from the

Q158: The difference between accrual-based revenue and accrual-based