Short Answer

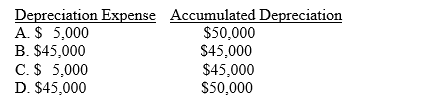

Axis Corporation purchased equipment at a cost of $100,000 in January, 2003. As of January 1, 2012, depreciation of $45,000 had been recorded on this asset. Depreciation expense for 2012 is $5,000. After the adjustments are recorded and posted at December 31, 2012, what are the balances for the Depreciation Expense and Accumulated Depreciation?

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Suppose a company received a $2,500 utility

Q44: What happens to the accounting equation when

Q45: Court Corporation purchased supplies at a cost

Q46: Which one of the following adjustments increases

Q47: Glass Corporation sold merchandise to a customer

Q49: Joe's Auto Company uses the accrual basis

Q50: Accumulated Depreciation:<br>A) increases with a debit.<br>B) decreases

Q51: Staple Corp. purchased supplies at a cost

Q52: Under which accounting method are revenues and

Q53: Adjusting journal entries are made at the