Short Answer

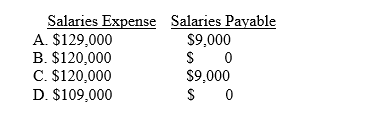

Match Incorporated recorded salary expense of $120,000 in 2012. However, additional salaries of $9,000 had been earned, but not paid or recorded at December 31, 2012. After the adjustments are recorded and posted at December 31, 2012, the balances in the Salaries Expense and Salaries Payable accounts will be

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Under accrual accounting, revenue is recognized:<br>A) when

Q3: Youngblood Company borrowed $100,000 on a one-year,

Q4: The following data were taken from the

Q6: Which of the following does not occur

Q7: Federer Corporation had $12,400 of supplies on

Q8: What happens to the accounting equation when

Q9: Accrued expenses originate from:<br>A) previously unrecorded expenses

Q10: Pine Corporation makes adjusting entries monthly. Property,

Q11: Zybo Incorporated operates a window washing business.

Q192: Failure to record accrued interest expense would