Essay

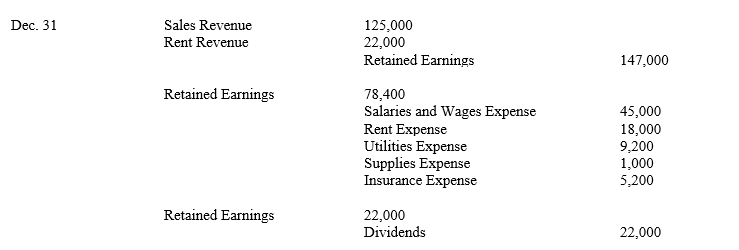

Big Dog Company began operations on January 1, 2012. The accountant for Big Dog has recorded the closing entries in the general journal at the company's year-end, December 31, 2012. In addition, the closing entries have been created in the computerized general ledger and the computer has generated a year-end trial balance. Since the closing entries have already been posted, the income statement that the computer printed has the proper account names, but all accounts have zero balances. In addition, the statement of retained earnings shows net income and dividends equal to zero instead of the correct 2012 net income and dividends. As you examine the general journal, you find the closing entries below:

In good form, prepare a statement of retained earnings for the year ended December 31, 2012. The beginning balance of retained earnings is zero.

In good form, prepare a statement of retained earnings for the year ended December 31, 2012. The beginning balance of retained earnings is zero.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: The asset account, Supplies, has a balance

Q22: Game Systems Corporation has grown significantly over

Q23: Timberland Company received advance payments from customers

Q24: Brooks Company sells merchandise to customers. Under

Q26: Explain the differences between the cash and

Q27: Saturn Co. rented out office space to

Q28: A company forgot to record four adjustments

Q29: Pine Corporation makes adjusting entries monthly. As

Q30: Which of the following entries properly closes

Q116: Which one of the following is an