Multiple Choice

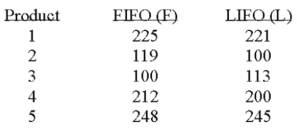

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) .A manufacturer evaluated its finished goods inventory (in $ thousands) for five products both ways.Based on the following results,is LIFO more effective in keeping the value of his inventory lower?  What is the value of calculated t?

What is the value of calculated t?

A) +1.93

B) 2.776

C) +0.47

D) -2.028

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Of 250 adults who tried a new

Q19: If two independent samples of size 10

Q21: To compare the effect of weather on

Q25: A study by a bank compared the

Q27: A national manufacturer of ball bearings is

Q28: If the decision is to reject the

Q29: A national manufacturer of ball bearings is

Q36: When is it appropriate to use the

Q40: If the null hypothesis states that there

Q124: For a hypothesis comparing two population means,