Multiple Choice

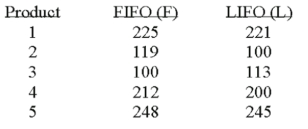

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) .A manufacturer evaluated its finished goods inventory (in $ thousands) for five products both ways.Based on the following results,is LIFO more effective in keeping the value of his inventory lower?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

A) Fail to reject the null hypothesis and conclude LIFO is more effective.

B) Reject the null hypothesis and conclude LIFO is more effective.

C) Reject the alternate hypothesis and conclude LIFO is more effective.

D) Fail to reject the null hypothesis and conclude LIFO is not more effective.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Of 250 adults who tried a new

Q25: A study by a bank compared the

Q27: A national manufacturer of ball bearings is

Q28: If the decision is to reject the

Q29: A national manufacturer of ball bearings is

Q31: A financial planner wants to compare

Q32: Accounting procedures allow a business to evaluate

Q33: If samples taken from two populations are

Q34: A national manufacturer of ball bearings is

Q61: If we are testing for the difference