Essay

The King Solomon Mining Company is contemplating a cash tender offer for the outstanding shares of Roanoke Coal Corporation. Roanoke Coal is expected to provide $162,500 in after-tax cash flow (after tax income plus CCA) each year for the next 20 years. In addition, Roanoke has a $630,000 tax loss carry-forward that King Solomon Mining can use over the next two years ($315,000 per year).

If King Solomon Mining's corporate tax rate is 34% and its cost of capital is 12%, what is the maximum cash price it should be willing to pay to acquire Roanoke?

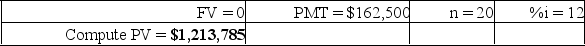

Present value of after-tax cash flows:

Correct Answer:

Verified

Present value of tax loss car...

Present value of tax loss car...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: When negotiating a merger offer,management and shareholders

Q9: When one company offers a large premium

Q36: One potential advantage of a merger to

Q46: Following a merger, the change in the

Q57: Which of the following firms would be

Q59: The write off of goodwill is a

Q62: Synergy is said to occur when the

Q79: Existing management of a firm is almost

Q81: Mergers after the financial crisis of 2008

Q102: Too much diversification has led some companies