Essay

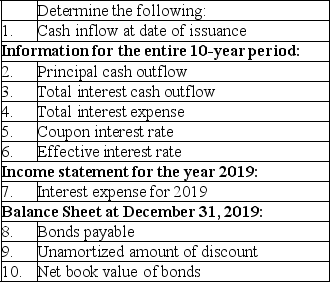

Steamboat Company issued the following ten-year bonds on January 1,2019: $100,000 maturity value,6% interest payable annually on each December 31.The bonds were dated January 1,2019 and the accounting period ends December 31.The bonds were issued for $93,000.Steamboat uses the effective-interest method for amortization.The amortization for 2019 was $510.

A.

B.Assuming instead that the accounting period ends on June 30,prepare the adjusting entry related to interest expense and the interest accrual at June 30.No adjusting entries have been made during the year.

B.Assuming instead that the accounting period ends on June 30,prepare the adjusting entry related to interest expense and the interest accrual at June 30.No adjusting entries have been made during the year.

Correct Answer:

Verified

Correct Answer:

Verified

Q77: Interest expense increases over time when a

Q78: On January 1,2019,Tonika Company issued a four-year,$10,000,7%

Q79: On January 1,2019,Jason Company issued $5 million

Q80: The cash payment for interest on a

Q81: Issuing bonds rather than stock will result

Q83: A bond's interest payments are determined by

Q84: The major disadvantages of issuing a bond

Q85: Zero coupon bonds are bonds that are

Q86: On March 31,2019,Topper Corp.retired bonds early by

Q87: The issuance price of a bond is