Multiple Choice

Mission Corp.borrowed $50,000 cash on April 1,2019,and signed a one-year 12%,interest-bearing note payable.The interest and principal are both due on March 31,2020.

-Assume that the appropriate adjusting entry was made on December 31,2019 and that no adjusting entries have been made during 2020.Which of the following would be the required journal entry to pay the entire amount due on March 31,2020?

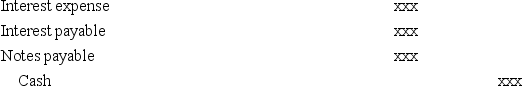

A)

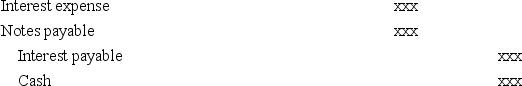

B)

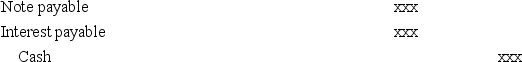

C)

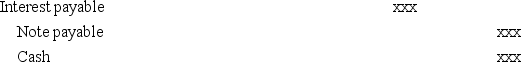

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q108: You have a goal of having $100,000

Q109: A company's income statement reported net income

Q110: Working capital increases when a company accrues

Q111: Border Company purchased a truck that cost

Q112: When a company receives cash before products

Q114: Which of the following correctly describes the

Q115: Smith Corporation entered into the following transactions:

Q116: SRJ Corporation entered into the following transactions:

Q117: Purchasing inventory on account increases the accounts

Q118: Which of the following results in a