Essay

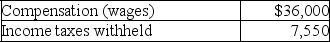

The following data were provided by the detailed payroll records of Mountain Corporation for the last week of March 2019,which will not be paid until April 5,2019:

FICA taxes at a 7.65% rate (no employee had reached the maximum).

FICA taxes at a 7.65% rate (no employee had reached the maximum).

A.Prepare the March 31,2019 journal entry to record the payroll and the related employee deductions.

B.Prepare the March 31,2019 journal entry to record the employer's FICA payroll tax expense.

C.Calculate the total payroll-related liabilities at March 31,2019 using the results of requirements (A)and (B).

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Operating leases are reported on the balance

Q33: Houston Company is involved in a lawsuit.In

Q34: Rusty Corporation purchased a rust-inhibiting machine by

Q35: Phipps Company borrowed $25,000 cash on October

Q36: Thomas Company borrowed $30,000 on March 1,2019.Thomas

Q38: Phipps Company borrowed $25,000 cash on October

Q39: Rae Company purchased a new vehicle by

Q40: Wages expense is an example of an

Q41: Libby Company purchased equipment by paying $5,000

Q42: In a recent year,The Walt Disney Company