Multiple Choice

Smith Company exchanges assets to acquire a building.The market price of the Smith stock on the exchange date was $35 per share and the building's book value on the books of the seller was $250,000. Which of the following journal entries is correct for Smith Company when Smith issues 10,000 shares of $10 par value common stock and pays $20,000 cash in exchange for the building?

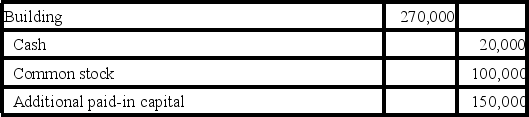

A)

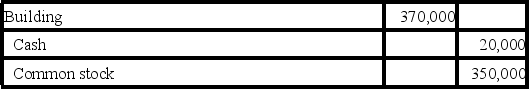

B)

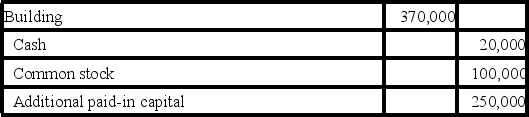

C)

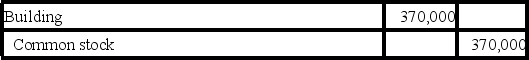

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q82: If a long-lived asset has been impaired,the

Q83: Operating leases<br>A)are reported on the balance sheet

Q84: On January 1,2017,Gordon Company purchased a patent

Q85: Which of the following statements is correct?<br>A)Companies

Q86: Schager Company purchased a computer system on

Q88: Sadler Corporation purchased equipment to be used

Q89: Under GAAP,research and development costs are capitalized

Q90: Goodwill is recorded only when an existing

Q91: In most cases,the depreciation method chosen for

Q92: Benson Mining Company purchased a site containing