Essay

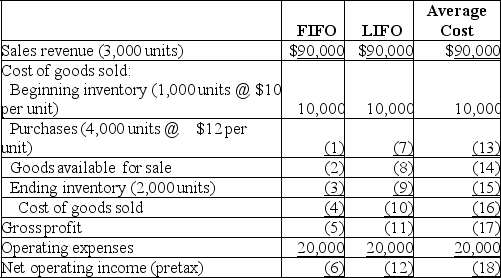

A.Compute the missing amounts in the income statement under three different inventory costing methods: (Ignore income taxes. )

B.Explain the results of the weighted-average inventory costing method compared to the FIFO and LIFO costing methods during a period of increasing unit costs.

B.Explain the results of the weighted-average inventory costing method compared to the FIFO and LIFO costing methods during a period of increasing unit costs.

Correct Answer:

Verified

A.

A.2,000 units × $12 = $24,000.

A.2,000 units × $12 = $24,000.

B.(1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

B.(1...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q79: Tinker's cost of goods sold in the

Q80: Which of the following is correct when,in

Q81: During periods of increasing unit costs,the LIFO

Q82: The journal entry to write down inventory

Q83: Which of the following statements is correct

Q85: Which of the following statements is incorrect?<br>A)Ending

Q86: An overstatement of the 2019 ending inventory

Q87: Under the FIFO cost flow assumption during

Q88: The inventory turnover<br>A)reflects how many times,on average,that

Q89: The LIFO Reserve represents the excess of