Essay

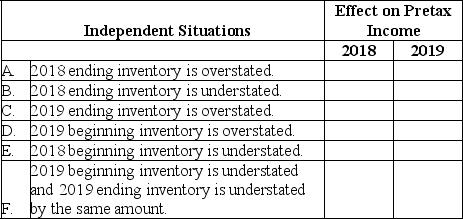

For each independent situation given below,determine the effect on pretax income for each.Enter "O" to indicate pretax income is overstated,"U" to indicate pretax income is understated,or "NA" to indicate that pretax income is not affected.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: An increase in inventory is subtracted from

Q10: The journal entry to write down inventory

Q11: Wilmington Company reported pretax income of $25,000

Q12: A company reported the following information for

Q13: A $25,000 overstatement of the 2019 ending

Q15: Lauer Corporation has provided the following information

Q16: A company using the periodic inventory system

Q17: Goods available for sale are allocated to

Q18: Atomic Company did not record a December

Q19: Under the LIFO cost flow assumption during