Essay

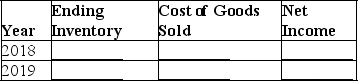

Redford Company hired a new store manager in October 2018,who determined the ending inventory on December 31,2018,to be $50,000.In March,2019,the company discovered that the December 31,2018 ending inventory should have been $58,000.The December 31,2019,inventory was correct.Ignore income taxes.

Complete the following table to show the effects of the inventory error on the four amounts listed.Give the amount of the discrepancy and indicate whether it was overstated (O),understated (U),or had no effect (N).

Correct Answer:

Verified

Correct Answer:

Verified

Q91: Inventory turnover under LIFO is greater than

Q92: Cranchey Company reported a LIFO ending inventory

Q93: Which of the following is correct?<br>A)The raw

Q94: Tinker's cost of goods sold in the

Q95: Jennings Company uses FIFO inventory costing.At the

Q97: Which of the following statements is incorrect

Q98: During periods of decreasing unit costs,use of

Q99: Assume Webster Company buys bicycle helmets at

Q100: At the end of 2019,a $5,000 understatement

Q101: RJ Corporation has provided the following information