Essay

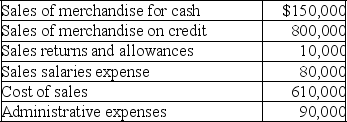

The following data were taken from the records of Lilo Corporation for the year ended

December 31,2019 before any adjustment for bad debt expense:

The following items have not been included in above amounts:

The following items have not been included in above amounts:

Estimated bad debt expense is 1% of credit sales.

The income tax rate is 35%.

10,000 of shares of common stock are outstanding.

A.Calculate the bad debt expense.

B.Prepare a multiple-step income statement (including gross profit,income before income taxes,and earnings per share).

Correct Answer:

Verified

A.Bad debt expense =...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q111: Prior to the year-end adjustment to record

Q112: The Roscoe Company's March 31 bank statement

Q113: The Conner Company's August 31 pre-reconciliation cash

Q114: The allowance for doubtful accounts is reported

Q115: Which of the following statements is correct?<br>A)Revenue

Q117: Illinois Company prepared the following bank reconciliation

Q118: Newark Company has provided the following information:

Q119: On June 1,2019,Concorde Company sold merchandise on

Q120: Deposits in transit are deducted from the

Q121: Hickory Corporation recorded sales revenue during the