Essay

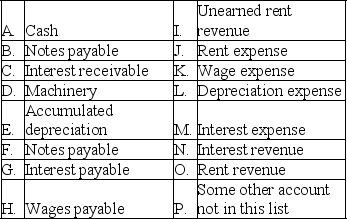

Lane Company is completing the accounting cycle at the end of its annual accounting period,December 31,2019.Adjusting entries have not been made during the year so three adjusting entries must be made to update the accounts.The following accounts,selected from the company's chart of accounts,are to be used for this purpose.They are coded to the left of each title for convenient reference.

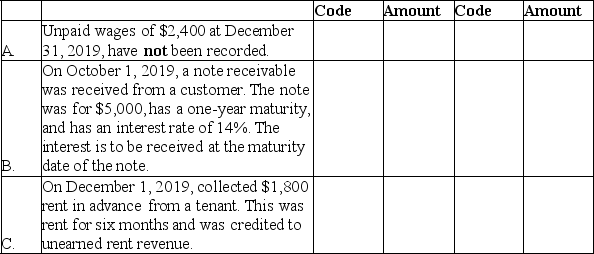

Indicate the appropriate account code and amount for each of the required adjusting entries at December 31,2019.

Indicate the appropriate account code and amount for each of the required adjusting entries at December 31,2019.

Transaction Debits Credits

Correct Answer:

Verified

A.All $2,400.

A.All $2,400.

B.($5...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

B.($5...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: Explain how adjusting entries provide for potential

Q49: Earnings per share is calculated by dividing

Q50: At the end of the accounting period,the

Q51: Rent of $4,000 collected in advance was

Q52: Income taxes incurred but not yet paid

Q54: Which of the following accounts requires a

Q55: Income statement accounts are temporary accounts because

Q56: Closing the revenue and gain accounts at

Q57: Top Company's 2019 sales revenue was $200,000

Q58: On September 1,2019,Fast Track,Inc.was started with $30,000