Essay

Below are four transactions that were completed during 2019 by Timber Lodge.The annual accounting period ends on December 31.Each transaction will require an adjusting entry at December 31,2019.

Prepare the 2019 adjusting entries required for Timber Lodge.

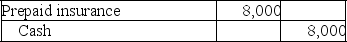

A.On July 1,2019,Timber Lodge paid a two-year insurance premium for a policy on its facilities.This transaction was recorded as follows:

B.On December 31,2019,a tenant renting some storage space from Timber Lodge had not paid the rent of $750 for December.

B.On December 31,2019,a tenant renting some storage space from Timber Lodge had not paid the rent of $750 for December.

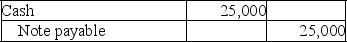

C.On September 1,2019,Timber Lodge borrowed $25,000 cash and gave a one-year,6 percent,note payable.The interest is payable on the note's due date of August 31,2020.The September 1,2019 transaction was recorded as follows:

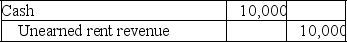

D.On October 1,2019,Timber Lodge collected $10,000 from a tenant for two years rent beginning October 1,2019.The $10,000 collection was recorded as follows:

D.On October 1,2019,Timber Lodge collected $10,000 from a tenant for two years rent beginning October 1,2019.The $10,000 collection was recorded as follows:

Correct Answer:

Verified

Correct Answer:

Verified

Q19: At the end of the accounting period,the

Q20: Which of the following accounts is used

Q21: On July 1,2019,Goode Company borrowed $100,000.The company

Q22: Which of the following is a false

Q23: The CHS Company paid $30,000 cash to

Q25: On April 1,2019,the premium on a one-year

Q26: The journal entry to adjust the prepaid

Q27: Which of the following best describes the

Q28: Which of the following adjusting journal entries

Q29: Which of the following transactions and events