Essay

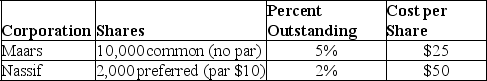

On January 1,2019,Heitzman Company purchased the following shares of stock as a long-term investment:

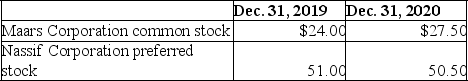

The fair values of the stocks subsequently were as follows:

The fair values of the stocks subsequently were as follows:

Calculate the amount of unrealized gain or loss Heitzman would report on its income statement at both December 31,2019 and December 31,2020.

Calculate the amount of unrealized gain or loss Heitzman would report on its income statement at both December 31,2019 and December 31,2020.

Correct Answer:

Verified

On December 31,2019: $350,000 - $342,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q55: A realized gain or loss is reported

Q56: If a bond is purchased at a

Q57: Which of the following statements regarding the

Q58: Under the equity method,dividends received are recognized

Q59: On January 1,2019,Shelley Company paid $650,000 cash

Q61: A decline in the fair value of

Q62: An unrealized holding loss is reported on

Q63: Lyrical Company purchased debt securities for $500,000

Q64: On April 1,2020,Paxton Corporation acquired all of

Q65: Which of the following statements is correct