Essay

On January 1,2019,Alden Company acquired 15,000 shares (4%)of the nonvoting preferred stock of Maxim Corporation as a long-term investment for $225,000.Maxim reported a 2019 net income of $35,000.On January 2,2020,Maxim declared and paid a $10,000 cash dividend on the preferred stock.The fair value of the Maxim stock held by Alden on December 31,2019,was $224,000.Alden Company has recorded only the following journal entries:

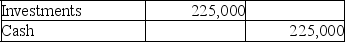

January 1,2019:

December 31,2019 (end of the accounting period):

December 31,2019 (end of the accounting period):

No entry

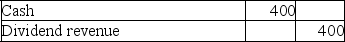

January 2,2020:

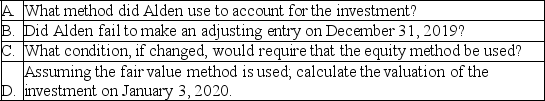

Based on the above information,answer the following questions:

Based on the above information,answer the following questions:

Correct Answer:

Verified

A.Fair value method,as is indicated by t...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Idaho Company purchased,as a long-term investment,30% of

Q3: Donald Corporation purchased 3,000 shares of the

Q4: On January 31,2018,McBurger Corporation purchased the following

Q5: Yoga Co.purchased 15% of Glow Company's outstanding

Q6: Phillips Corporation purchased 1,000,000 shares of Martin

Q8: On March 31,2019,Kudos Corporation paid $20,000,000 for

Q9: The assets of a subsidiary are depreciated

Q10: Libby Company purchased debt securities for $100,000

Q11: Gilman Company purchased 100,000 of the 250,000

Q12: Piano Company owns 55% of the voting