Essay

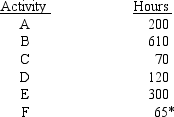

Willy is involved in a number of businesses as a consultant. Below are the businesses and the hours of activity that Willy spent in each. Identify any activities that are passive and explain why the income or loss from the other activities is not passive income or loss.  *F is Willy's sole proprietorship and he has no employees.

*F is Willy's sole proprietorship and he has no employees.

Correct Answer:

Verified

C: THE ONLY PASSIVE ACTIVITY

B: Willy pa...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

B: Willy pa...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: A sole proprietor:<br>A)deducts his or her retirement

Q8: Sabrina is single and has taxable income

Q12: What is the difference between a limited

Q63: The S corporation income tax return includes

Q64: Other Objective Questions<br>Indicate by a PRP if

Q65: The AAA of the S corporation is

Q71: An S corporation shareholder can only deduct

Q77: Simpco Partnership has gross operating revenue of

Q82: To qualify for the limited deduction for

Q100: The owners of a limited liability company