Multiple Choice

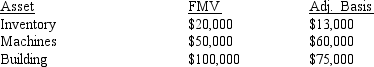

What is Alexander's net gain or loss on the liquidation of his 100 percent interest in an S corporation if the corporation distributes the following three assets to him in exchange for his stock:  Prior to any distributions, Alexander's basis in his S corporation interest was $160,000.

Prior to any distributions, Alexander's basis in his S corporation interest was $160,000.

A) ($12,000)

B) ($22,000)

C) $10,000

D) $22,000

Correct Answer:

Verified

Correct Answer:

Verified

Q10: What tax year end must a partnership

Q16: Other Objective Questions<br>Indicate by a PRP if

Q17: Which of the following is not a

Q19: Only 50 percent or more of the

Q29: The accumulated adjustment account<br>A)is a shareholder account.<br>B)can

Q41: A loss is never recognized on a

Q74: A sole proprietorship:<br>A)must be owned by an

Q79: Which of the following is not a

Q81: Logan's basis in his partnership interest is

Q87: How are income and loss apportioned to