Essay

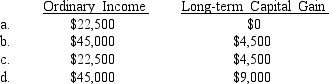

Dominguez Corporation, a calendar-year S corporation, has book income of $54,000 ($45,000 from operations and a $9,000 net long-term capital gain). During the year, Dominquez distributes $22,500 to its three equal shareholders, all of whom are calendar year taxpayers. What is the total amount of Dominguez's ordinary income and capital gains passed through to its shareholders at the end of the year?

Correct Answer:

Verified

d; all ordinary inco...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Jonathan's basis in his S corporation stock

Q14: How does a shareholder's basis in his

Q24: A general partner in a limited partnership

Q44: For the 2018 tax year, King Corporation,

Q50: Partners pay taxes on their share of

Q54: Kevin and Jennifer are 60% and 40%

Q56: Once established at entry, a partner's basis

Q73: Wilhelmina operates a daycare center in her

Q78: Greg and Samantha plan to establish a

Q119: Briefly explain the four loss limitation rules