Multiple Choice

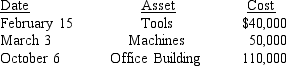

During the year, Garbin Corporation (a calendar-year corporation that manufactures furniture) purchased the following assets:  In computing depreciation of these assets, which of the following averaging conventions will be used?

In computing depreciation of these assets, which of the following averaging conventions will be used?

A) Half-year and mid-month

B) Mid-quarter and mid-month

C) Half-year, mid-quarter, and mid-month

D) Mid-quarter only

Correct Answer:

Verified

Correct Answer:

Verified

Q3: 13 Bonus depreciation and Section 179 expensing

Q17: The adjusted basis of an asset is:<br>A)Its

Q20: Allen Corporation acquired 5-year property costing $150,000

Q31: A donee's basis in a gift is

Q45: On November 7, 2018, Wilson Corporation acquires

Q46: Software purchased in 2018 is eligible for<br>A)

Q52: The after-tax cost of an asset<br>A)Is higher

Q57: What is the difference in the basis

Q69: Other Objective Questions<br>Indicated by a P for

Q73: Research expenditures must be capitalized and amortized