Multiple Choice

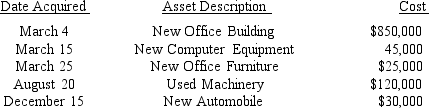

YumYum Corporation (a calendar-year corporation) moved into a new office building adjacent to its manufacturing plant in 2018. It purchased and placed in service the following assets during 2018:  All assets are used 100% for business use. The office building does not include the cost of the land on which it is located that was an additional $300,000. The corporation had $900,000 income from operations before calculating depreciation deductions. If YumYum does not apply Section 179 expensing or bonus depreciation, but elects to use straight-line depreciation on all of its assets, how much is its 2018 depreciation deduction?

All assets are used 100% for business use. The office building does not include the cost of the land on which it is located that was an additional $300,000. The corporation had $900,000 income from operations before calculating depreciation deductions. If YumYum does not apply Section 179 expensing or bonus depreciation, but elects to use straight-line depreciation on all of its assets, how much is its 2018 depreciation deduction?

A) $17,281

B) $28,972

C) $35,134

D) $35,394

Correct Answer:

Verified

Correct Answer:

Verified

Q9: The cost of assets with useful lives

Q13: In May 2017, Stephen acquired a used

Q44: Automobiles are subject to specific limitations on

Q52: The after-tax cost of an asset<br>A)Is higher

Q55: Gonzalez Corporation is a calendar-year taxpayer.What is

Q61: Research and experimentation expenditures can be:<br>A)Expensed when

Q63: On June, 20, 2018, Simon Corporation (a

Q66: Josephine Company, a sole proprietorship whose owner

Q97: Sanjuro Corporation (a calendar-year corporation) purchased and

Q109: Warren leases an auto valued at $18,750