Multiple Choice

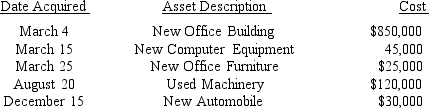

YumYum Corporation (a calendar-year corporation) moved into a new office building adjacent to its manufacturing plant in 2018. It purchased and placed in service the following assets during 2018:  All assets are used 100% for business use. The office building does not include the cost of the land on which it is located that was an additional $300,000. The corporation had $900,000 income from operations before calculating depreciation deductions. What is the maximum Section 179 deduction YumYum can claim for 2018?

All assets are used 100% for business use. The office building does not include the cost of the land on which it is located that was an additional $300,000. The corporation had $900,000 income from operations before calculating depreciation deductions. What is the maximum Section 179 deduction YumYum can claim for 2018?

A) $500,000

B) $253,160

C) $208,000

D) $25,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Useful lives for realty include all of

Q7: On June 20, 2018 Baker Corporation (a

Q8: Momee Corporation, a calendar-year corporation, bought only

Q34: Other Objective Questions<br>Indicated by a P for

Q42: What is the adjusted basis of an

Q62: What is the difference between depreciation, depletion,

Q64: The lease inclusion amount increases the deduction

Q71: When would it be advisable to use

Q72: The cost of an asset with a

Q87: Other Objective Questions<br>Indicated by a P for