Multiple Choice

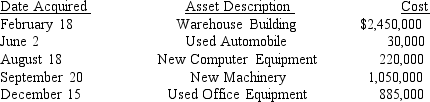

Sanjuro Corporation (a calendar-year corporation) purchased and placed in service the following assets during 2018:  All assets are used 100% for business use. The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000. The corporation has $3,000,000 income from operations before calculating depreciation deductions. Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2018.

All assets are used 100% for business use. The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000. The corporation has $3,000,000 income from operations before calculating depreciation deductions. Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2018.

What would be Sanjuro Corporation's cost recovery deduction for the used office equipment for 2019?

A) $0

B) $129,797

C) $442,500

D) $18,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: MACRS means<br>A)Modified asset cost recovery system<br>B)Mid-year accelerated

Q10: The after-tax cost of a depreciable asset

Q15: Sanjuro Corporation (a calendar-year corporation) purchased and

Q19: On June, 20, 2018, Simon Corporation (a

Q20: YumYum Corporation (a calendar-year corporation) moved into

Q32: What is the maximum amount that can

Q33: Zachary purchased a new car on August

Q50: Martin Corporation acquired 5-year property costing $2,185,000

Q84: What are listed properties?

Q92: Morgan Corporation, a calendar-year corporation, purchased a