Multiple Choice

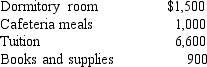

Natasha graduated at the top of her high school class and received a $10,000 scholarship to attend the college of her choice. Natasha decided to attend State University and spent her $10,000 as follows:  How much of the $10,000 should Natasha report as gross income?

How much of the $10,000 should Natasha report as gross income?

A) $10,000

B) $3,400

C) $2,500

D) $1,500

E) zero

Correct Answer:

Verified

Correct Answer:

Verified

Q28: In 1992, when Sherry was 56 years

Q29: Fannie purchased ten $1,000 bonds from her

Q31: Put T for Taxable income or N

Q40: George and Georgette divorced in 2017.George was

Q41: George can invest $10,000 in a tax-exempt

Q50: Which of the following types of income

Q52: All stock dividends are nontaxable.

Q63: Kimberly gave 100 shares of stock to

Q67: Indicate whether each of the items listed

Q81: Shelly is in the 24 percent tax