Multiple Choice

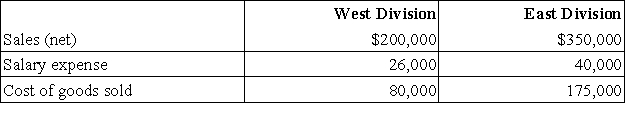

Fallow Corporation has two separate profit centers.The following information is available for the most recent year:  The West Division occupies 5,000 square feet in the plant.The East Division occupies 3,000 square feet.Rent,which was $40,000 for the year,is an indirect expense and is allocated based on square footage.Compute operating income for the West Division.

The West Division occupies 5,000 square feet in the plant.The East Division occupies 3,000 square feet.Rent,which was $40,000 for the year,is an indirect expense and is allocated based on square footage.Compute operating income for the West Division.

A) $120,000.

B) $95,000.

C) $94,000.

D) $69,000.

E) $54,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Costs that the manager has the power

Q23: Part AR3 costs the Southwestern Division of

Q25: Responsibility accounting performance reports:<br>A)Become more detailed at

Q26: A responsibility accounting performance report displays:<br>A)Only actual

Q28: Kragle Corporation reported the following financial data

Q29: The Mixed Nuts Division of Yummy Snacks,Inc.had

Q32: Using the information below,compute the manufacturing cycle

Q58: Investment center managers are typically evaluated using

Q86: Joint costs can be allocated either using

Q142: With respect to cycle time, companies strive