Essay

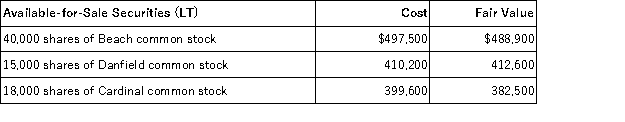

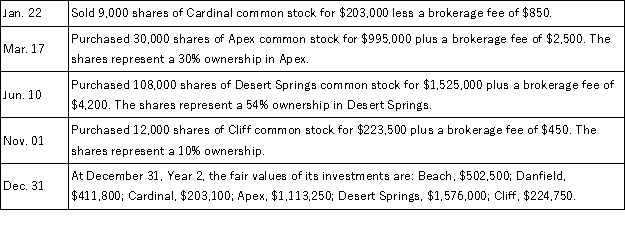

Weston Company had the following long-term available-for-sale securities in its portfolio at December 31,Year 1.Weston had several long-term investment transactions during the next year.After analyzing the effects of each transaction, (1)determine the amount Weston should report on its December 31,Year 1 balance sheet for its long-term investments in available-for-sale securities, (2)determine the amount Weston should report on its December 31,Year 2 balance sheet for its long-term investments in available-for-sale securities, (3)prepare the necessary adjusting entry to record the fair value adjustment at December 31,Year 2.

Correct Answer:

Verified

Year 1: $1,307,300 - $1,284,000 = $23...

Year 1: $1,307,300 - $1,284,000 = $23...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Investments in debt and equity securities that

Q9: On February 15,Jewel Company buys 7,000 shares

Q10: Investments in held-to-maturity debt securities are always

Q12: If a company owns more than 20%

Q45: Hamasaki Company owns 30% of CDW Corp.

Q106: On May 1 of the current year,

Q136: All companies desire a low return on

Q150: A company had net income of $40,000,

Q151: Investments in equity securities where the investor

Q153: Select the correct statement from the following:<br>A)