Essay

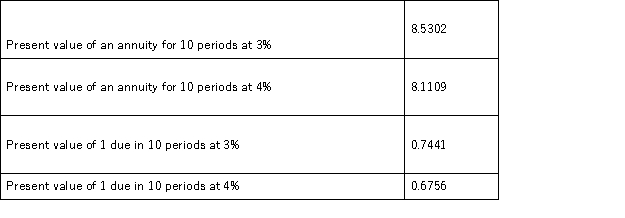

A company issues 6%,5 year bonds with a par value of $800,000 and semiannual interest payments.On the issue date,the annual market rate of interest is 8%.Compute the issue (selling)price of the bonds..The following information is taken from present value tables:

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Return on equity increases when the expected

Q30: One of the similarities of bond and

Q74: The legal contract between the issuing corporation

Q94: All of the following statements regarding leases

Q99: If a bond's interest period does not

Q100: On January 1,a company issues bonds dated

Q102: A corporation borrowed $125,000 cash by signing

Q102: On January 1,Year 1,Stratton Company borrowed $100,000

Q121: A discount on bonds payable occurs when

Q164: Callable bonds can be exchanged for a