Essay

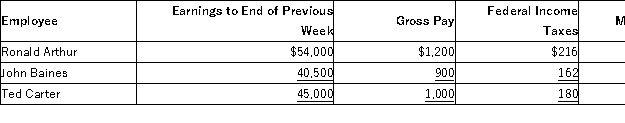

The payroll records of a company provided the following data for the weekly pay period ended December 7:  The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a)accrue the payroll and (b)record payroll taxes expense.

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a)accrue the payroll and (b)record payroll taxes expense.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Vacation benefits are a type of

Q33: Recording employee payroll deductions may involve:<br>A)Liabilities to

Q34: If a company has advance subscription sales

Q35: An employee earned $37,000 during the year

Q36: Star Recreation receives $48,000 cash in advance

Q38: Gary Marks is paid on a monthly

Q39: A company has 90 employees and a

Q41: During August,Boxer Company sells $356,000 in merchandise

Q42: During June,Vixen Fur Company sells $850,000 in

Q124: A _ is a potential obligation that