Essay

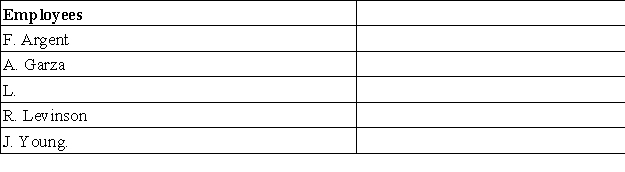

A company's employees had the following earnings records at the close of the current payroll period:  The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $117,000 of earnings plus 1.45% FICA Medicare on all wages;0.6% federal unemployment taxes on the first $7,000;and 2.5% state unemployment taxes on the first $7,000.Compute the employer's total payroll taxes expense for the current pay period.

The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $117,000 of earnings plus 1.45% FICA Medicare on all wages;0.6% federal unemployment taxes on the first $7,000;and 2.5% state unemployment taxes on the first $7,000.Compute the employer's total payroll taxes expense for the current pay period.

Correct Answer:

Verified

1Employee pay subject to unemp...

1Employee pay subject to unemp...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: _ are amounts owed to suppliers for

Q39: _are amounts received in advance from

Q44: Companies with many employees often use a

Q106: The employer should record deductions from employee

Q108: On May 22,Jarrett Company borrows $7,500 from

Q109: The rate that a state assigns reflecting

Q111: A company's income before interest expense and

Q114: All of the following statements regarding uncertainty

Q115: Triston Vale is paid on a monthly

Q163: On September 15, SkateWorld borrowed $70,000 cash