Essay

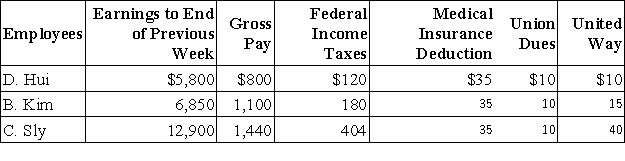

The payroll records of a company provided the following data for the current weekly pay period ended March 12.  Assume that the Social Security portion of the FICA taxes is 6.2% on the first $117,000 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $117,000 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Correct Answer:

Verified

Correct Answer:

Verified

Q57: Trey Morgan is an employee who is

Q58: On November 1,Alan Company signed a 120-day,8%

Q61: Obligations to be paid within one year

Q64: The deferred income tax liability:<br>A)Results from the

Q65: The amount of federal income taxes withheld

Q67: A company has three employees.Total salaries for

Q108: Gross pay is:<br>A) Take-home pay.<br>B) Total compensation

Q129: A _ is a written promise to

Q131: The difference between the amount borrowed and

Q133: The total compensation an employee earns including