Essay

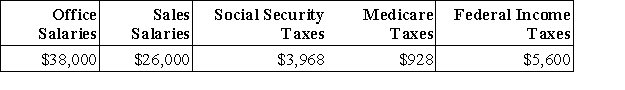

Deacon Company provides you with following information related to payroll transactions for the month of May.Prepare journal entries to record the transactions for May.  a.Recorded the May payroll using the payroll register information given above.

a.Recorded the May payroll using the payroll register information given above.

b.Recorded the employer's payroll taxes resulting from the May payroll.The company had a merit rating that reduces its state unemployment tax rate to 3.5% of the first $7,000 paid each employee.Only $42,000 of the current months salaries are subject to unemployment taxes.The federal rate is 0.6%.

c.Issued a check to Reliant Bank in payment of the May FICA and employee taxes.

d.Issued a check to the state for the payment of the SUTA taxes for the month of May.

e.Issued a check to Reliant Bank in payment of the employer's quarterly FUTA taxes for the first quarter in the amount of $1,020.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Gross pay less all deductions is called

Q36: A _ shows the pay period dates,

Q70: Employer payroll taxes:<br>A)Are added expenses beyond that

Q71: Times interest earned is calculated by:<br>A)Multiplying interest

Q72: Trey Morgan is an employee who is

Q76: Accounts payable are:<br>A)Amounts owed to suppliers for

Q77: Which of the following is not true

Q78: When a company is obligated for sales

Q79: An employee earned $62,500 during the year

Q108: _are probable future payments of assets