Multiple Choice

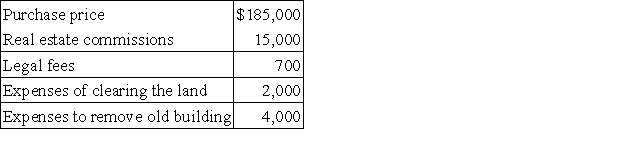

Merchant Company purchased property for a building site.The costs associated with the property were:  What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

A) $187,700 to Land;$19,000 to Building.

B) $200,700 to Land;$6,000 to Building.

C) $200,000 to Land;$6,700 to Building.

D) $185,000 to Land;$21,700 to Building.

E) $206,700 to Land;$0 to Building.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Land improvements are:<br>A) Assets that increase the

Q113: A company purchased land with a building

Q114: On January 1,a company purchased machinery for

Q115: Flask Company reports net sales of $4,315

Q116: An asset's book value is $36,000 on

Q119: A company sold a machine that originally

Q120: Gaston owns equipment that cost $90,500 with

Q121: A company purchased a tract of land

Q122: Minor Company installs a machine in its

Q194: Suarez Company uses the straight-line method of