Essay

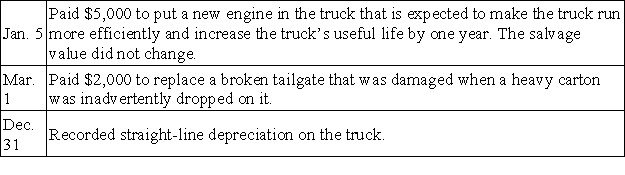

In year one,McClintock Co.acquired a truck that cost $75,500 with an estimated $14,000 salvage value and 4 year estimated useful life.Depreciation in the first year was $15,375.McClintock had the following transactions involving plant assets during Year 2.Unless otherwise indicated,all transactions were for cash.  Prepare the general journal entries to record these transactions.

Prepare the general journal entries to record these transactions.

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Additional costs of plant assets that provide

Q62: A company exchanged its used machine for

Q63: Depreciation:<br>A)Measures the decline in market value of

Q64: Fortune Drilling Company acquires a mineral deposit

Q65: A company had average total assets of

Q66: Which of the following is not classified

Q68: A company bought new heating system for

Q69: A company purchased and installed equipment on

Q71: A leasehold is:<br>A)A short-term rental agreement.<br>B)The same

Q72: Peavey Enterprises purchased a depreciable asset for