Essay

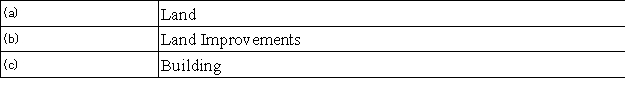

A company paid $595,000 for property that included land appraised at $384,000;land improvements appraised at $128,000;and a building appraised at $288,000.The plan is to use the building as a manufacturing plant.Determine the amounts that should be recorded as:

Correct Answer:

Verified

Correct Answer:

Verified

Q107: A change in an accounting estimate is:<br>A)

Q144: On September 30 of the current year,a

Q145: The depreciation method that allocates an equal

Q146: A company used straight-line depreciation for an

Q147: A company purchased a weaving machine for

Q149: Martinez owns machinery that cost $87,000 with

Q150: Marlow Company purchased a point of sale

Q151: The specific meaning of goodwill in accounting

Q152: Plant assets are defined as:<br>A)Tangible assets that

Q153: A company purchased a delivery van for