Essay

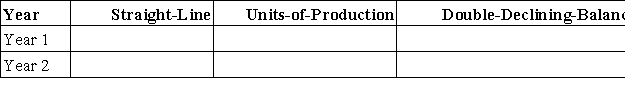

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1.The company estimates the machine will produce 1,050,000 units of product during its life.It actually produces the following units for the first 2 years: Year 1,260,000;Year 2,275,000.Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method.Show calculation of amounts below the table.

Correct Answer:

Verified

Straight-line: $450,000- $30,000/4 = $1...

Straight-line: $450,000- $30,000/4 = $1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q119: A company sold a machine that originally

Q120: Gaston owns equipment that cost $90,500 with

Q121: A company purchased a tract of land

Q122: Minor Company installs a machine in its

Q126: On April 1,2015,due to obsolescence resulting from

Q127: A company discarded a computer system originally

Q128: The useful life of a plant asset

Q129: The depreciation method that charges the same

Q180: The insufficient capacity of a company's plant

Q194: Suarez Company uses the straight-line method of