Multiple Choice

A company ages its accounts receivables to determine its end of period adjustment for bad debts.At the end of the current year,management estimated that $15,750 of the accounts receivable balance would be uncollectible.Prior to any year-end adjustments,the Allowance for Doubtful Accounts had a debit balance of $375.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

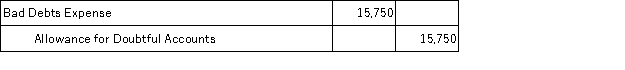

A)

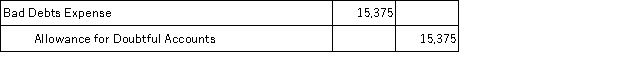

B)

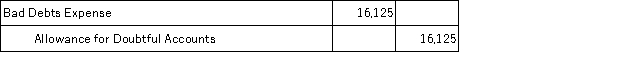

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Jasper makes a $25,000,90-day,7% cash loan to

Q19: A company receives a 10%,120-day note for

Q20: A credit sale of $5,275 to a

Q21: Jervis accepts all major bank credit cards,including

Q22: A method of estimating bad debts expense

Q26: Uniform Supply accepted a $4,800,90-day,10% note from

Q27: Uniform Supply accepted a $4,800,90-day,10% note from

Q28: The allowance method based on the idea

Q124: The maturity date of a note receivable:<br>A)

Q205: The_ method of accounting for bad debts