Multiple Choice

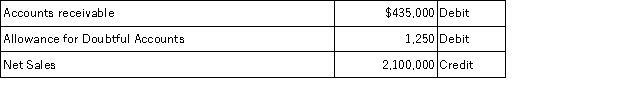

The unadjusted trial balance at year-end for a company that uses the percent of receivables method to determine its bad debts expense reports the following selected amounts:  All sales are made on credit.Based on past experience,the company estimates 3.5% of ending account receivable to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit.Based on past experience,the company estimates 3.5% of ending account receivable to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

A) Debit Bad Debts Expense $13,975;credit Allowance for Doubtful Accounts $13,975.

B) Debit Bad Debts Expense $15,225;credit Allowance for Doubtful Accounts $15,225.

C) Debit Bad Debts Expense $16,475;credit Allowance for Doubtful Accounts $16,475.

D) Debit Bad Debts Expense $7,350;credit Allowance for Doubtful Accounts $7,350.

E) Debit Bad Debts Expense $17,350;credit Allowance for Doubtful Accounts $17,350.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Orman Co. sold $80,000 of accounts receivable

Q55: The _ method uses both past and

Q58: A promissory note:<br>A) Is a short-term investment

Q67: White Company allows customers to make purchases

Q68: On July 9,Mifflin Company receives a $8,500,90-day,8%

Q69: Giorgio Italian Market bought $4,000 worth of

Q73: Frederick Company borrows $63,000 from First City

Q76: Craigmont uses the allowance method to account

Q88: A company allows its customers to use

Q96: At December 31 of the current year,