Multiple Choice

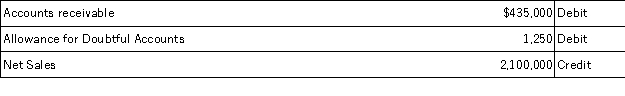

The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the percent of sales method to determine its bad debts expense.  All sales are made on credit.Based on past experience,the company estimates 1% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit.Based on past experience,the company estimates 1% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

A) Debit Bad Debts Expense $19,750;credit Allowance for Doubtful Accounts $19,750.

B) Debit Bad Debts Expense $15,225;credit Allowance for Doubtful Accounts $15,225.

C) Debit Bad Debts Expense $22,250;credit Allowance for Doubtful Accounts $22,250.

D) Debit Bad Debts Expense $7,350;credit Allowance for Doubtful Accounts $7,350.

E) Debit Bad Debts Expense $21,000;credit Allowance for Doubtful Accounts $21,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q76: Craigmont uses the allowance method to account

Q77: Craigmont uses the allowance method to account

Q78: On July 9,Mifflin Company receives a $8,500,90-day,8%

Q79: A finance company or bank that purchases

Q80: A company has net sales of $1,200,000

Q82: Bonita Company estimates uncollectible accounts using the

Q83: Sellers allow customers to use credit cards

Q85: Pepperdine reported net sales of $8,600 million,net

Q93: A company that uses the percent of

Q170: Each December 31, Kimura Company ages its