Essay

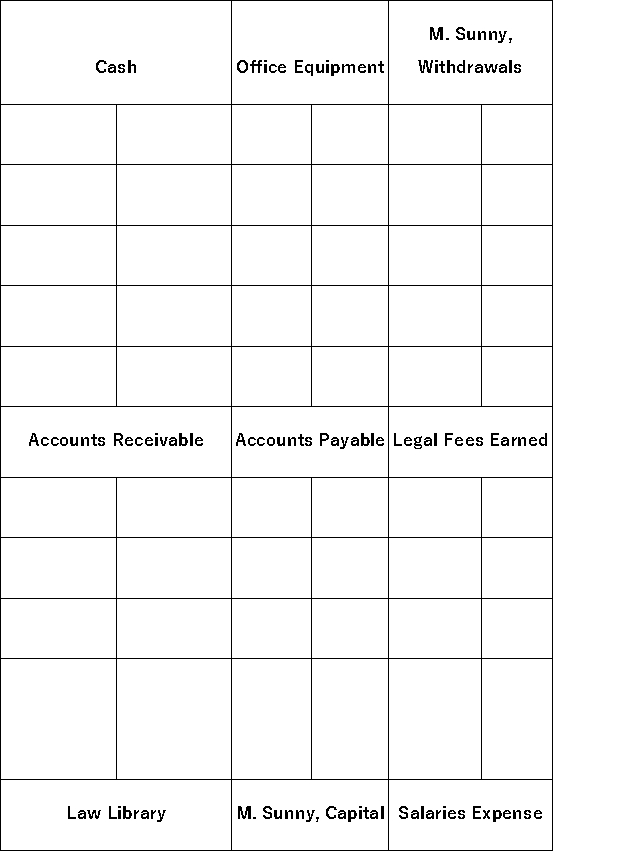

Mary Sunny began business as Sunny Law Firm on November 1.Record the following November transactions by making entries directly to the T-accounts provided.Then,prepare a trial balance,as of November 30.

a)Mary invested $15,000 cash and a law library valued at $6,000.

b)Purchased $7,500 of office equipment from John Bronx on credit.

c)Completed legal work for a client and received $1,500 cash in full payment.

d)Paid John Bronx.$3,500 cash in partial settlement of the amount owed.

e)Completed $4,000 of legal work for a client on credit.

f)Mary withdrew $2,000 cash for personal use.

g)Received $2,500 cash as partial payment for the legal work completed for the client in (e).

h)Paid $2,500 cash for the legal secretary's salary.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The_ is found by determining the difference

Q38: Identify the account used by businesses to

Q39: Identify the accounts that would normally have

Q40: At the beginning of the current year,Trenton

Q42: Golddigger Services Inc.provides services to clients.On May

Q44: A company's ledger is:<br>A)A record containing increases

Q45: The posting process is the link between

Q156: Crediting an expense account decreases it.

Q210: The higher a company's debt ratio, the

Q214: Withdrawals by the owner are a business