Multiple Choice

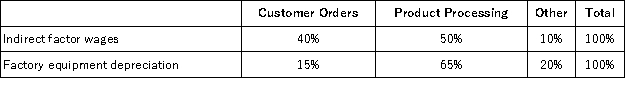

Naples Corporation has provided the following data from its activity-based costing accounting system:  Distribution of resource consumption across activity cost pools:

Distribution of resource consumption across activity cost pools:  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.How much indirect factory wages and factory equipment depreciation cost would be assigned to the Product Processing activity cost pool?

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.How much indirect factory wages and factory equipment depreciation cost would be assigned to the Product Processing activity cost pool?

A) $260,000

B) $429,000

C) $169,000

D) $780,000

E) $351,000

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Activity cost pools are not a necessary

Q22: Mirkle Corporation uses the following activity rates

Q23: A system of assigning costs to departments

Q25: Activity based costing can improve costing activity

Q27: Kozlov Corporation has provided the following data

Q28: Quantum Corporation has provided the following data

Q30: Which of the following is not a

Q31: Founder Consulting Corporation has its headquarters in

Q40: In activity-based costing, all overhead is lumped

Q60: A plantwide overhead rate method is adequate