Essay

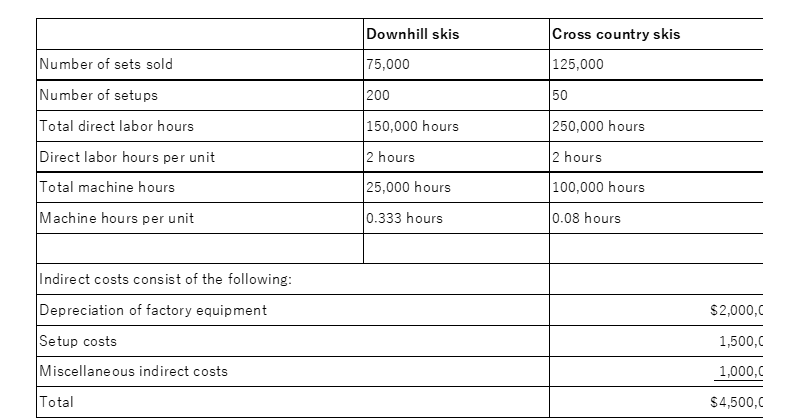

Winterland, Inc., produces two types of skis, downhill skis and cross country skis. Product and production information about the two items is shown below:

Required:

1. If Winterland uses the traditional two-stage method of allocating overhead costs based on direct labor hours, what is the amount of indirect costs per set of skis for each of the two types of skis?

2. If Winterland uses activity based costing, what is the total amount of indirect costs per set of skis for each of the two types of skis? Assume that depreciation is allocated based on machine hours, setup costs based on the number of setups, and miscellaneous costs based on the number of direct labor hours.

Correct Answer:

Verified

1. Traditional costing:

Tot...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Tot...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Unit costs can be significantly different when

Q10: The following is taken from Clausen Company's

Q12: Rockaway Company produces two types of product,flat

Q13: Mirkle Corporation uses the following activity rates

Q14: Quantum Corporation has provided the following data

Q16: The following is taken from Jeffers Company's

Q17: The following is taken from Clausen Company's

Q20: Rockaway Company produces two types of product,flat

Q37: When using a plantwide overhead rate method

Q61: Activity-based costing can be especially effective in